Get the free donation form

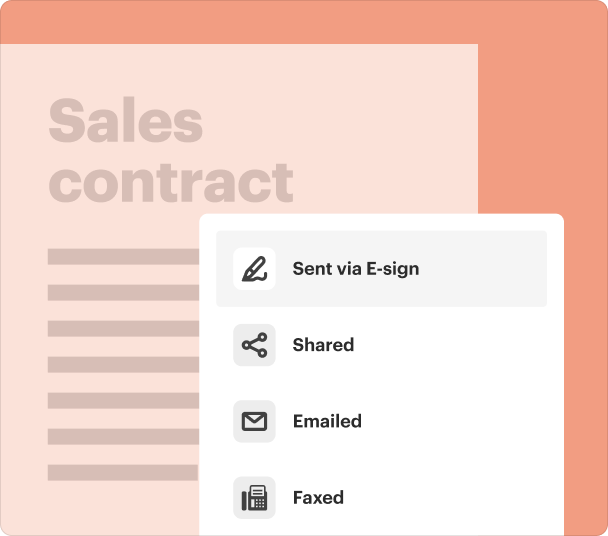

Fill out, sign, and share forms from a single PDF platform

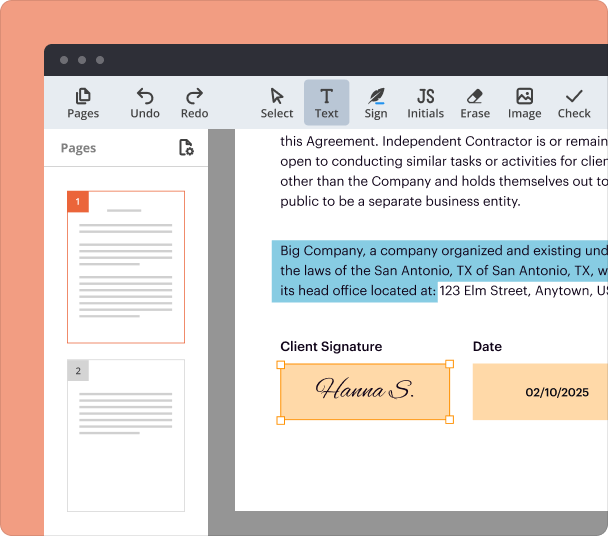

Edit and sign in one place

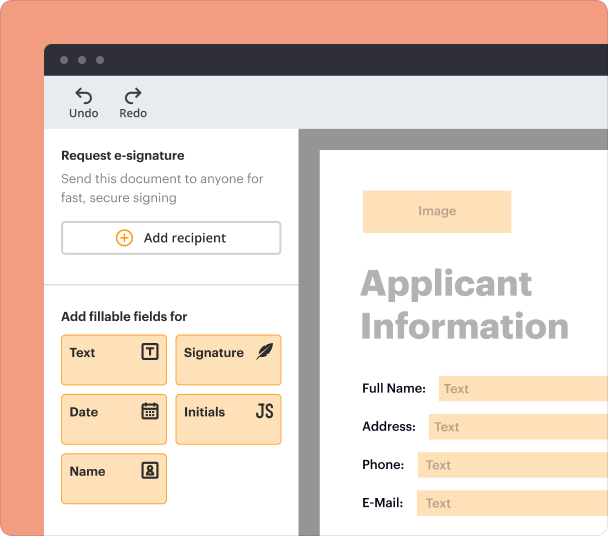

Create professional forms

Simplify data collection

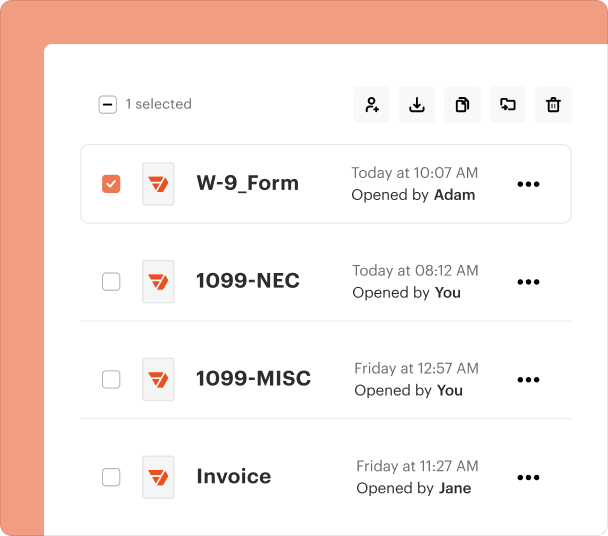

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

Complete Guide to Tax Write Off Form Process on pdfFiller

Filling out a tax write off form can save both individuals and businesses significant amounts in taxes. This guide walks you through the entire process, ensuring you understand everything from eligibility to common mistakes to avoid.

What are tax write offs?

Tax write offs refer to specific expenses that can be deducted from your total income, thus lowering your taxable amount. Understanding their importance is vital for maximizing your tax refund or minimizing your tax liability. Individuals and businesses alike can leverage tax write offs to optimize their financial positions.

-

Tax write offs reduce taxable income, thereby decreasing tax liabilities.

-

Deductions lower taxable income; write-offs and credits provide direct reductions in tax owed.

-

Certain expenses, such as business costs or charitable donations, qualify for write offs, as outlined by IRS guidelines.

Which tax write offs are common for businesses?

Business owners should take advantage of various tax write offs to optimize their tax returns. Understanding eligible write offs helps businesses lower overall costs and improve financial health.

-

Expenses incurred while establishing a business, such as legal fees and promotional materials, can be deducted.

-

Costs related to promoting your business are essential write offs that can enhance visibility.

-

Expenses paid for professional services, including accounting and consulting, are often deductible.

-

Premiums for business insurance policies can be written off, enhancing financial security.

-

Costs related to business travel and meals can be partially deducted when properly documented.

How do prepare my tax write off form?

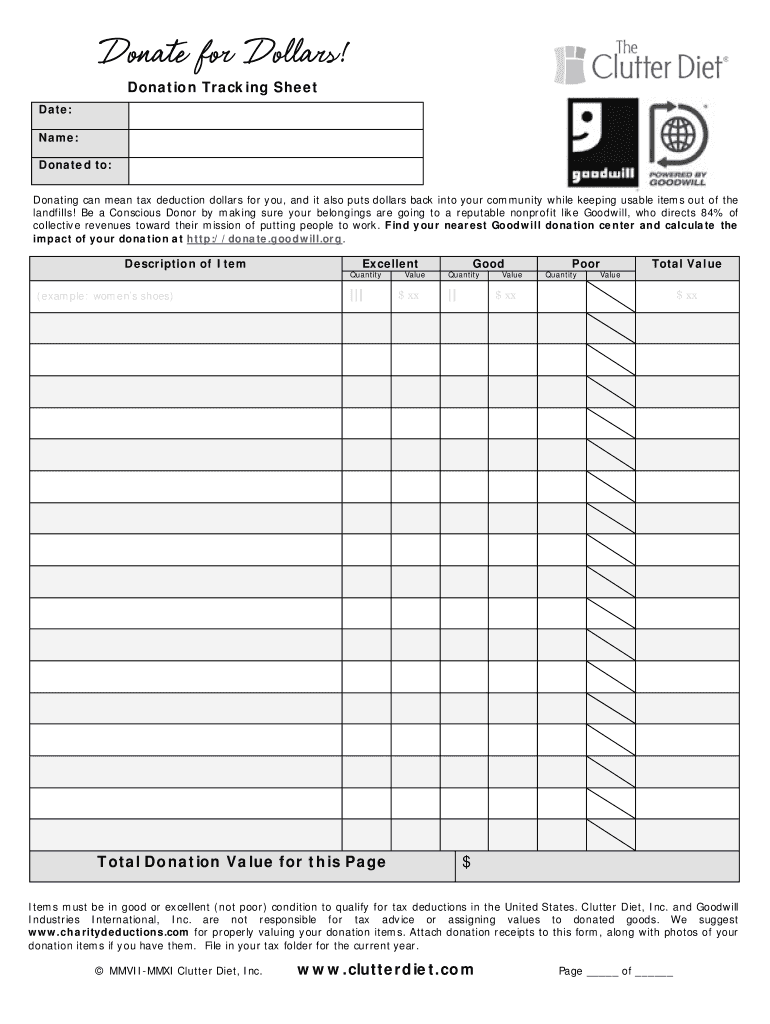

Preparing your tax write off form requires attention to detail and accurate documentation. Essential documents ensure successful submission of deductions while avoiding delays in the tax process.

-

Gather receipts, invoices, and proof of payment to support your claims.

-

Using pdfFiller simplifies the process with clear steps on how to fill out your write off form.

-

Ensure you accurately value any charitable contributions based on fair market value to justify write-offs.

How to fill out the tax write off form on pdfFiller?

Using pdfFiller’s interactive tools, filling out your tax write off form becomes straightforward and efficient. This platform provides numerous features designed to assist users with form management.

-

Follow the guided process on pdfFiller to fill out your form accurately.

-

Utilize pdfFiller’s robust editing tools and e-signature options to streamline your submission.

-

Save and access your completed forms from anywhere with pdfFiller's cloud storage.

What are common mistakes to avoid?

When filing tax write offs, mistakes can lead to discrepancies or IRS audits. Being aware of frequent errors helps ensure a smoother filing process.

-

Ensure correct calculations and data entry to prevent filing issues.

-

Double-check your write-off claims against IRS guidelines to avoid complications.

-

Maintain thorough records and receipts, as lack of documentation can invalidate claims.

What to expect after my submission?

Understanding the review process of submitted tax forms is crucial for effective follow-up. Knowing what to anticipate helps manage expectations.

-

Tax forms will undergo a review by the IRS, checking for discrepancies and validity.

-

Your write-offs may be approved, denied, or flagged for further review based on your submission.

-

Prepare for additional communication with the IRS if discrepancies arise after filing.

How do interactive tools on pdfFiller enhance the process?

pdfFiller provides a range of interactive tools that facilitate efficient tax management. These tools support individuals and teams in calculating potential tax savings and collaborating effectively.

-

Use tools on pdfFiller to calculate potential savings from your write offs.

-

Teams can work together seamlessly on tax documents using pdfFiller’s collaborative functions.

-

Access a wealth of information and guidance within pdfFiller to improve your tax filing experience.

Frequently Asked Questions about donation form pdf download

What is a tax write off form?

A tax write off form allows individuals and businesses to list eligible expenses that can be deducted from their taxable income. This can help lower the overall tax liability and maximize potential refunds.

Can I use pdfFiller for my tax write off form?

Yes, pdfFiller offers a user-friendly platform where you can easily fill out, edit, and manage your tax write off form. The interactive tools simplify the process for users.

What types of expenses can be written off?

Common write offs include business travel expenses, advertising costs, and charity donations. It's important to maintain detailed records to support your claims.

How can I avoid mistakes when filing my tax write off?

To avoid mistakes, ensure accurate calculations and documentation. Double-check your forms against IRS guidelines to ensure compliance and correctness.

What happens if the IRS flags my tax write off?

If flagged, the IRS may request additional documentation or clarification. It is crucial to be prepared with supporting documents to resolve any issues that may arise.

pdfFiller scores top ratings on review platforms